capital gains tax canada 2020

Canada Capital Gains Tax 2022 with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world. Schedule 3 is used by individuals to calculate capital gains or losses.

Solved Mike Patel Has The Following Sources Of Income And Chegg Com

New Hampshire doesnt tax income but does tax dividends and interest.

. As of 2022 it stands at 50. A Capital Gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the. For people with visual impairments the following alternate formats are also available.

The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. What To Know - Advisorsavvy 1 week ago Feb 13 2020 The capital gains tax is the same for everyone in Canada currently 50.

The inclusion rate is the percentage of your gains that are subject to tax. Whats new for 2020. Canada Capital Gains Tax Calculator 2022 - Real Estate 1 week ago Web Jun 10 2022 The capital gains tax rate in Canada can be calculated by adding the income tax rate in each.

The inclusion rate has varied over time see graph below. Dividends distributed within taxable periods commencing after. On line 12700 enter the positive amount from line 19900 on your Schedule 3If the amount on line 19900 on your Schedule 3 is negative a loss do not.

Completing your income tax return. In Canada 50 of the value of any capital gains are taxable. Capital Gains Tax In Canada.

5000-S3 Schedule 3 - Capital. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22. So for example if you buy a.

For best results download and open this form in Adobe ReaderSee General information for details. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. The inclusion rate for personal.

Because you only include one half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of a LCGE of. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to.

So for example if you. You may be able to claim the capital gains. Lifetime capital gains exemption limit For dispositions in 2020 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit.

Income Tax Slab For Nris For Fy 2021 22 2020 21 Ay 2021 22 Sbnri

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Investment Property How Much Can You Write Off On Your Taxes Pardee Properties

Corporate Tax Rates Around The World Tax Foundation

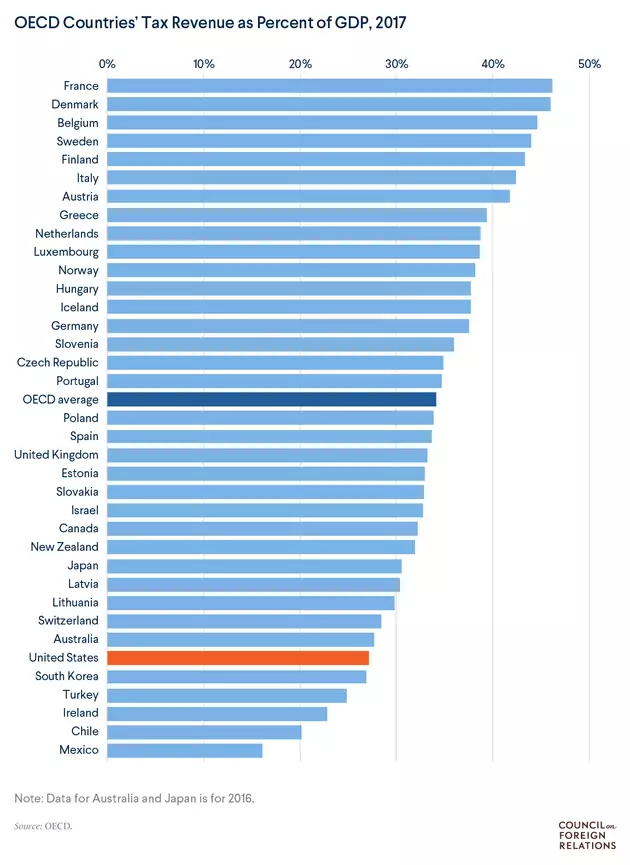

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

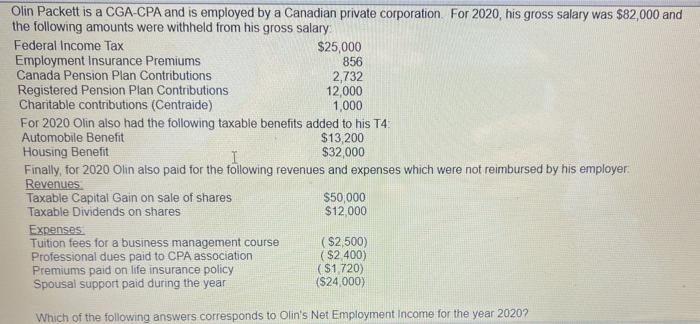

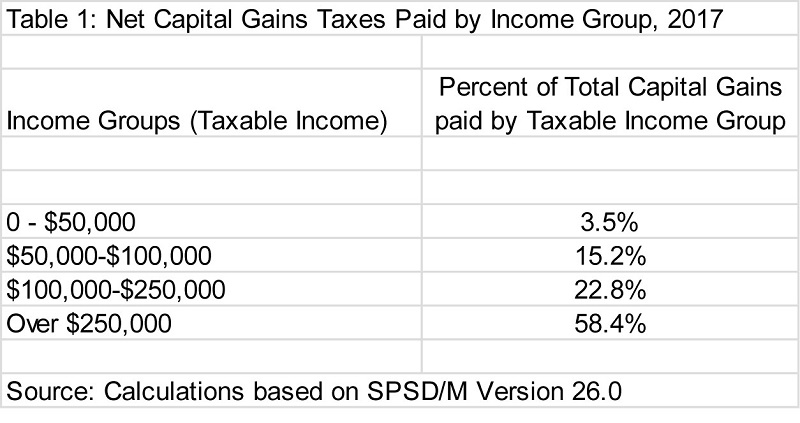

Misunderstandings About Capital Gains Taxes Fraser Institute

How To Know If You Have To Pay Capital Gains Tax Experian

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Capital Gains Tax Rate Rules In Canada What You Need To Know

All About Capital Gains Tax For Real Estate In Canada Elevate Realty

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Foundation President Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top Integrated Tax

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

How To Calculate Capital Gains Tax For The U S Or Canada Akif Cpa

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget